BAKERIES TO ADAPT TO NEW CONSUMPTION PATTERNS OR DIE

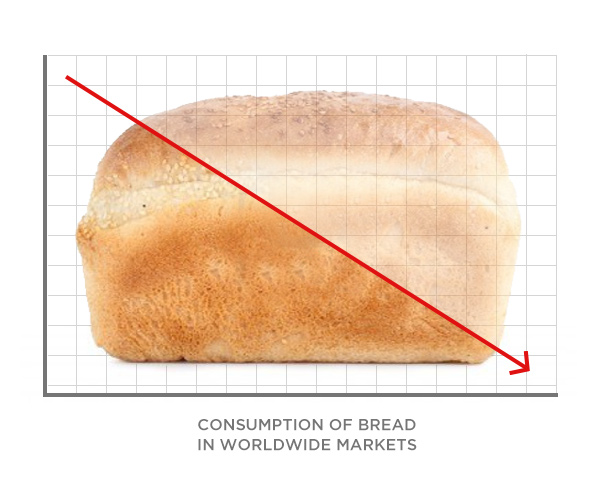

According to research by Mintel, bread consumption in France has declined by 10% over the past 10 years; whilst Italy has seen a decrease from 200g to 80g per capita over the same time period. The UK has also seen a decline of 2% year-on-year.

According to Judy Laidlaw, Marketing Manager for Bakery and Grains at Supreme and RCL Foods Milling, there are numerous reasons for this decline.

“Consumers’ fast-paced lifestyles leave them with little time to shop, they have less income due to the effects of the global recession, many are on bread-free diets, there is a decline in breakfast eating, and smaller households which don’t need such large quantities of bread are becoming the norm,” she says.

The end result is that bakeries need to adapt to market conditions and adapt their offerings or they will suffer and perhaps even close as a result.

“Today’s consumers are enjoying on-the-go snacking products, ethnic and exotic breads and home-made quality goods. There has also been a large move towards gluten and wheat free options which bakeries need to add to their shelves,” says Judy.

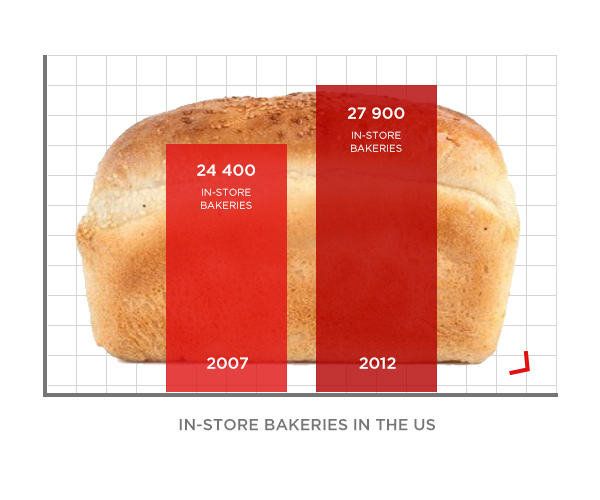

“Consumers are looking for around the clock options that they can pick up at a time that suits their daily routine. That’s why we’ve seen a boom in in-store bakeries in the United States and even in South Africa,” she adds.

Judy explains that US bakery in-store sales reached an all-time high in 2012, with sales growing 5.6% to $12.8 billion. The number of in-store bakeries grew by 14%, from 24 400 (2007) to 27 900 (2012). “This is phenomenal growth when compared to the package bread segment, which saw less than 1% growth in 2012.”

Some retailers are taking in-store bakeries to the next level by creating a traditional bakery feel within the store, whilst others are ensuring the convenience that consumers need by coming up with all kinds of new ideas – even a cupcake vending machine.